Shelf Companies

The Shelf Company Advantage

Shelf companies are existing LLCs that have been formed by this law firm, never used, and intended to be transferred to a client. A shelf company has the advantage of being immediately available along with the benefit of aging.

We offer shelf LLCs (no corporations) that have been specifically formed in Texas, Nevada, or Wyoming for this purpose. Shelf companies do not include EINs, bank accounts, a D&B rating, or other features not expressly mentioned.

Certain shelf companies may be formed using a revocable trust as sole member and manager for anonymity purposes. Entities with anonymity features are more expensive.

Shelf companies are popular and difficult to keep in stock. Inventory is limited and subject to change without notice.

Company Package

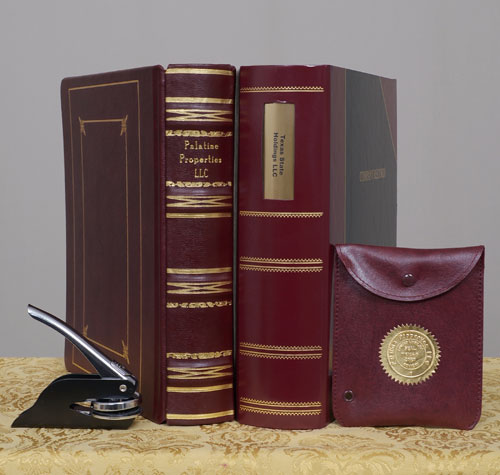

Shelf companies include premium legal documents with an attractive company book, seal, and membership certificates. It is a professional-grade package.

Fees and Costs

Traditional shelf LLCs begin at $1,750. Series LLC shelf companies begin at $2,350. Each involves a $175 filing fee. Other fees may apply if the client selects optional add-on features. Fees increase for older companies.

Shelf Company Policies

Shelf companies may not be reserved or placed on hold without payment. Inquiring about a shelf company does not reserve it. Until full payment is made, any particular shelf company remains on the market.

For Texas companies, one year of registered agent services by our attorney is included. Registered agent fees are $250 annually thereafter and include annual meetings upon request.

Certain of our shelf company offerings may be in the form of LLC combinations (a two-company structure or a hub-sub structure) that are available only as a combined unit and may not be split.

All clients are required to supply a mailing address that will become public record (we suggest a box at a UPS or FedEx store) before the shelf company will be transferred to the client. An amendment will be promptly filed with the secretary of state that reflects the new address.

Specific types of company books (hardbound, leather, etc.) can vary according to the status of the supply chain. This is out of our control.

Sales of shelf companies are final since they involve unique and proprietary intellectual content. No refunds. No exceptions.

Shelf Companies Sold

SOLD – Portana Properties LLC, a traditional Texas LLC

SOLD – Anchor Asset Holdings LLC, a Texas series LLC

SOLD – Astoria Asset Holdings LLC and Astoria Asset Management LLC, being a Texas series LLC and a traditional Texas LLC respectively

SOLD – Alamo Asset Holding LLC and Alamo Asset Management LLC, a two-company structure

SOLD – Marathon Property Holdings LLC and Marathon Property Management, a two-company structure

SOLD – Paramount Property Holdings LLC, a Texas series LLC and an anonymity company

SOLD – Corinthian Capital LLC, a Nevada series LLC and an anonymity company

SOLD – Colonnade Capital LLC, a Texas series LLC and an anonymity company

SOLD – Criterion Capital LLC, a Nevada series LLC and an anonymity company.

SOLD – Avana LLC, a Traditional Texas LLC DBA “Associated Properties” and “Asana Asset Management”

SOLD – Anova Assets LLC, a Traditional Texas LLC DBA “Antares Asset Management” and “Regional Realty”

SOLD – Castlebar Capital LLC, a Nevada Series LLC DBA “Pace Properties” and “Investor Funding Associates”

SOLD – Lakeshore LLC, a Texas Series LLC DBA “Bayshore Holdings” and “Heron Holdings”

SOLD – Directed Capital LLC, a Texas Series LLC DBA “Property Concepts” and “Oberon Assets”

SOLD – Ravenna Captial Management LLC, a Traditional Texas LLC DBA “Veranova Ventures” and “Pacera Properties”

SOLD – Portovera Properties LLC, a Texas Series LLC DBA “Pilar Properties” and “Padua Properties”

SOLD – HUB-SUB – Altasana LLC, the sub company, a Texas Series LLC owned by Series A of Altamesa LLC, a Nevada series LLC.

SOLD – Caranova Capital LLC, a traditional Texas LLC DBA “Morena Management” and “Valmora Ventures”

SOLD – Plaza Properties LLC, a traditional Texas LLC DBA “Phoenix Properties” and “Regency Asset Management”

SOLD – Polaris Properties LLC, a Nevada Series LLC DBA “North Star Properties” and “Star Asset Management”

SOLD – Exemplar Holdings LLC, a Texas Series LLC DBA “Templar Holdings” and “Charter Properties”

SOLD – Palisade Properties LLC, a Texas Series LLC DBA “Pennant Properties” and “Pentagon Properties”

SOLD – Rio Grande Holdings LLC, a Nevada Series LLC DBA “Texas Property Holdings” and “Texas Asset Managers”

SOLD – Dynamic Development Interests LLC, a Texas Series LLC DBA “Performance Properties” and “ProTex Investments”

SOLD – Paradigm Alliance LLC, a Traditional Texas LLC DBA “Paradigm Point” and “Harbor Holdings”

SOLD – Hub-Sub – Inland Interests LLC, a Texas Series LLC owned by Series A of Universal Asset Management LLC, a Nevada Series LLC

SOLD – Wall Street Holdings LLC, a Traditional Texas LLC DBA “Gulf Coast Management” and “Gulf Coast Properties”

SOLD – Mandala Management LLC, a Traditional Texas LLC DBA “Advanced Investments” and “Asset Managers of Texas”

SOLD – Calibrated Property Systems LLC, a Traditional Texas LLC DBA “CPS Properties” and “Property Systems”

SOLD – MeriTex Management LLC, a Traditional Texas LLC DBA “Meridian Management” and “Prima Properties”

SOLD – Houston Home Solutions LLC, a Texas Series LLC DBA “Houston Asset Management” and “Horizon Property Management”

SOLD – Monarch Mansions LLC, a Texas Series LLC DBA “Monarch Homes,” “Monarch Management,” and “Monarch Interests”

SOLD – Sunny Home Strategies LLC, a Texas Series LLC DBA “Sunny Homes,” “Precision Properties,” and “Hyperion Holdings”

SOLD – Apex Advantage LLC, a Texas Series LLC DBA “Apex Asset Management,” “Infinity Interests,” and “Diversified Asset Management”

SOLD – Intellicon Interests LLC, a NV Series LLC DBA “Southwest Properties,” “High Five Holdings,” and “Invictus Investments”

SOLD – Proton Properties LLC, a NV Series LLC DBA “Grey Wolf Investments”

SOLD – Hub-Sub Structure – Affiliated Asset Management LLC, a Texas Series LLC owned by Series A of Harbor Holdings LLC, a Nevada series LLC

“One of the best company formations I have ever had done. Quick service and the documents were written well beyond my expectations. I will be using Mr. Willis for all of my legal formations and annual document reviews from here on out.”

“The professionalism provided by David J Willis in organizing our real estate LLCs has been reassuring. So glad we took the extra steps to form a truly protected LLC formation to protect our assets. We have had a constant email conversation throughout the process, and have never been surprised by extra costs from what was originally given to us. If you are serious about protecting yourself from lawsuits, please read David’s book and spend the money to professionally organize your business.”