Asset Protection Review (APR)

Clients facing a lawsuit or judgment need expert guidance when it comes to protecting vulnerable assets and facilitating permissible transfers. As a Texas asset protection attorney, we mobilize the resources of the Texas Constitution, the Property Code, and Texas case law to protect the homestead, wages and salaries, retirement plans, and certain personal property from execution on a judgment.

An asset protection review (APR) is a good starting point if a client is uncertain about what action to take when confronted with litigation or a judgment. Our goal for the client is to construct a strategic assessment of the client’s vulnerability along with suggested steps to better protect assets.

APR Format

In terms of format, the APR is a dialogue between attorney and client (rather than a formal analysis or report). It is conducted entirely online, supplemented by a phone or video call if necessary.

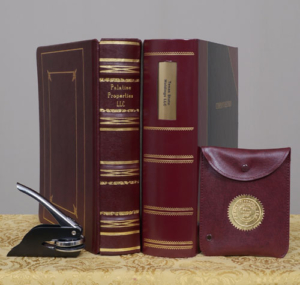

We form traditional LLCs and Series LLCs in Texas and Nevada

Beginning the APR

If you would like to proceed with an APR, we would ask that you first provide us with a concise list of assets and liabilities (not full financials); a narrative description of your current circumstances and entity/asset protection structure, if any; and a summary of any legal action that may be currently on file or threatened.

If litigation is pending, we would also need to know if any written discovery (interrogatories or requests for production) has been served upon you, and if you have replied (If so, we will need copies). It is important for us to know what you may have already disclosed to the plaintiff.

Asset Protection Retainer

The additional option of a fixed-term retainer is available for clients who need asset-protection guidance that extends beyond the two-hour APR. In such cases we offer a flat-fee asset protection retainer for 30, 60, or 90 days.

Retaining us as your Texas asset protection lawyer insures that we are available for legal advice and guidance during a critical period.

An advance asset protection strategy is the best defense

Payment

Advance payment is required. There are a variety of available payment options on the website’s payment page, including credit/debit and Paypal, as well as wire transfer and direct deposit to our operating account at Wells Fargo. If you would like a no-obligation statement prior to making payment, we will gladly provide one. Files go into our queue in the order in which payment is made.

No Tax, Bookkeeping, or Accounting Advice

Our asset protection counsel does not include tax, bookkeeping, or accounting advice. We are not tax advisors, nor do we have a CPA on staff. All clients are encouraged to consult a qualified CPA and/or investment advisor as part of the client’s professional team in order to be fully informed on the tax and financial implications of proposed asset protection measures.

Next Steps

Please complete our Client Inquiry Form. Our initial response will be preliminary and general in nature and not a formal legal opinion or consultation. You will then have the option of proceeding with paid legal services if you wish.

APR fees and terms are explained in our consultation engagement letter which you will be asked to sign and return.

Thank you for your interest in our law firm. We look forward to being of assistance to you.

“Six years ago, David guided me through implementing an asset protection plan. I was sued by two major banks. Both got six-figure judgments but no one collected a dime. David knows real estate law and asset protection!”