LLC Formation

in Texas

LLCs for Asset Protection

In our role as Texas asset protection advisors, we form LLCs to minimize liability and maximize asset protection. Read our article LLC Formation in Texas.

Series limited liability companies are a focus of ours. Many of the new companies we establish are series LLCs because of the simplicity, economy, and flexibility associated with being able to hold multiple assets in the same LLC but in separate compartmentalized series.

We are also ready to advise you on the new Texas law relating to registered series.

See all of the asset protection structures in graphics format.

Do you need a consultation?

If you are undecided about which action to take, need to discuss your legal options, or require legal advice and information before you can proceed, then a paid consultation with our attorney is your best first step. We offer an entity-structuring consultation that is designed for this specific purpose.

Our online consultation process has proven very popular with clients, because the discussion is unrushed and the client has a written email record of the legal advice given. Please review our online consultation process and fees.

If you know exactly what you want you want in an LLC, you may bypass the initial consultation and complete our LLC Formation Checklist. Inquire for the latest copy.

Next Steps

Please complete our Client Inquiry Form. Our initial response will be preliminary and general in nature and not a formal legal opinion. You will then have the option of proceeding with paid legal services if you wish.

Thank you for your interest in our law firm. We look forward to assisting you with LLC formation.

Entity Structuring

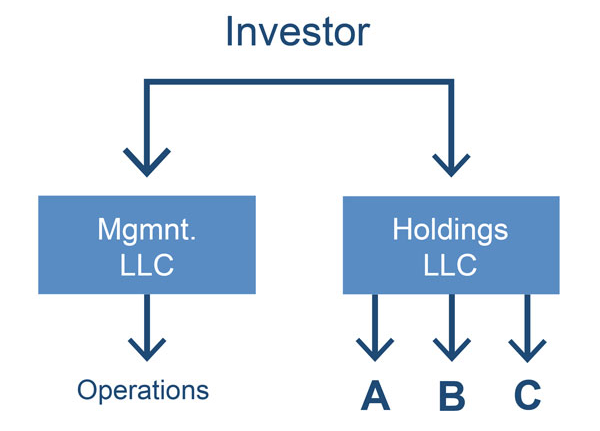

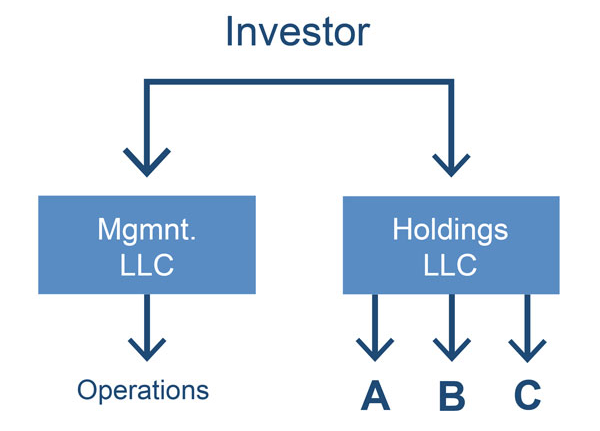

Our recommended two-company LLC structure is based on the principle of separation of activities from assets:

Two-Company Structure

This structure benefits not just real estate investors but anyone who has public dealings while also holding hard assets.

See graphics of our asset protection structures.