Asset Protection Overview

Texas offers unique protections for both income and assets that can be integrated into an asset protection plan. In other states, execution on a judgment can strip you of your possessions and put you on the street, but that is not usually true in Texas.

The best approach is to formulate an asset protection strategy well before adverse events occur. However, if a lawsuit is anticipated, or if a judgment creditor is expected to attempt collection, then it may not be too late for a Texas resident to maximize legal protections.

Asset Protection Review

An asset protection review (APR) is a good place to begin if one is uncertain about what action to take regarding a business or investment structure or defending assets in Texas. The APR is a thorough analysis of circumstances and goals with practical recommendations for client action. We utilize the Texas Constitution, the Property Code, and Texas case law to assist the client in creating a protection plan for the homestead, wages and salaries, retirement funds, and personal property.

In terms of format, the APR is a dialogue between attorney and client, rather than a formal analysis or report. It is conducted online, supplemented by a follow-up phone or video call if necessary. The maximum available attorney time of two hours may be spread over three business days after which the APR automatically concludes.

By way of explanation, the APR is not a three-day consultation. We allow the consultation to be spread over the specified time, up to the two-hour maximum, in order to facilitate thorough and thoughtful Q&A with the client. Our online consultations follow a specific process. See consultation process and fees for additional details on what to expect.

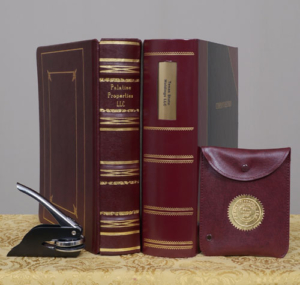

We form traditional LLCs and Series LLCs in Texas and Nevada

Entity-Structuring for Asset Protection

A major part of our practice is devoted to LLC formation and designing entity structures that minimize liability, enhance anonymity, deter lawsuits, and insulate assets from judgments. We are often able to simplify the way our clients do business while significantly improving their asset protection. If you would like more detail on these issues, view our library of more than fifty articles. For a visual approach, see graphics of various asset protection structures.

Series LLCs in Texas and Nevada

We form both traditional and series LLCs in Texas and Nevada. Inquire about our recommended two-company structure for real estate investors. Most investors do not need a more elaborate structure than this. If you have an existing traditional LLC or series LLC that was formed with only a minimal, one-pager-type filing, we can fully re-document it with new, professional-grade documents that bring the company current and up to par with the latest in Texas asset protection law.

We also handle conversions to a Texas series LLC and conversions from member-managed LLCs to manager-managed companies.

We also maintain an inventory of established shelf companies for immediate shipment.

Role of Trusts

While trusts do not have a liability barrier as do LLCs, there are a variety of ways that trusts can be used in asset protection including land trusts and anonymity trusts for real estate investors.

Trusts may also be used in conjunction with an LLC as part of an entity structure. And while not (strictly speaking) an asset protection device, living trusts for the homestead are an excellent means of avoiding probate as part of an overall estate plan.

Asset Protection Retainer

There are times when expert ongoing advice is called for, beyond the scope of an initial consultation. Clients facing a lawsuit or judgment may need continuing expert counsel when it comes to protecting vulnerable assets and facilitating permissible transfers.

Having your asset protection attorney on retainer as litigation or the judgment-execution process unfolds can be invaluable. It is not uncommon for our asset protection guidance to save a client tens or even hundreds of thousands of dollars. Asset protection retainers are available at a flat fee for 30, 60, or 90 day terms. Inquire.

Note that an asset protection retainer arrangement assumes that the client also has a litigation attorney available to handle the mechanics of the legal case. For a variety of good reasons, one’s asset protection attorney should not be the same person as one’s litigation attorney.

Transmission of Supporting Documentation

After retaining us, please send copies of supporting documents by email or fax to (832) 201-5327. We do not open a file or save attachments until payment is made, so please wait until after you have retained us to send documents and attachments as there will be no file to put them in. Please supply only documents that are directly relevant to your legal issues.

We do not offer consultations or any other legal services by text. Texting may be suitable for quick personal communications, but sentence fragments and one-liners are insufficient for professional discussions of complex asset protection matters. A keyboard device is required.

No Tax, Bookkeeping, or Accounting Advice

Our asset protection counsel does not included tax, accounting, or bookkeeping advice. We are not specialized tax advisors, nor do we have a CPA on staff. All clients are encouraged to consult a qualified CPA and/or investment advisor as part of the client’s professional team in order to be fully informed on the tax and financial implications of a proposed asset protection structure.

Legal Fees

We transparently post a comprehensive schedule of services and fees. Advance payment is required. There are a variety of available payment options including credit/debit and Paypal, as well as wire transfer and direct deposit to our operating account at Wells Fargo.

If you would like a no-obligation statement prior to making payment, we will gladly provide one. Files go into our queue in the order in which payment is made.

Next Steps

Please complete our brief Client Inquiry Form. Our initial response to your inquiry will be preliminary and general in nature and not a formal legal opinion or consultation.

No appointment is necessary to begin the consultation process. We can begin promptly after receiving basic facts, background documents, and payment from the client.

We hope the foregoing information has been helpful. Thank you for your interest in exploring asset protection options with our law firm. We look forward to being of assistance to you.

“Six years ago, David guided me through implementing an asset protection plan. I was sued by two major US banks. Both got six-figure judgments but no one collected a dime. David knows real estate law and asset protection!”

“I hired Mr. Willis to create two series LLC’s and re-doc a third LLC. He is quick to respond and very knowledgeable. Most importantly, he is reliable. Recently, I had an apartment complex under contract to purchase, and Mr. Willis created a new LLC well within the short contract period, which allowed me to close the deal without any stress. I absolutely recommend his services to all real estate investors in Texas.”