Entity Structuring – Asset Protection Graphics

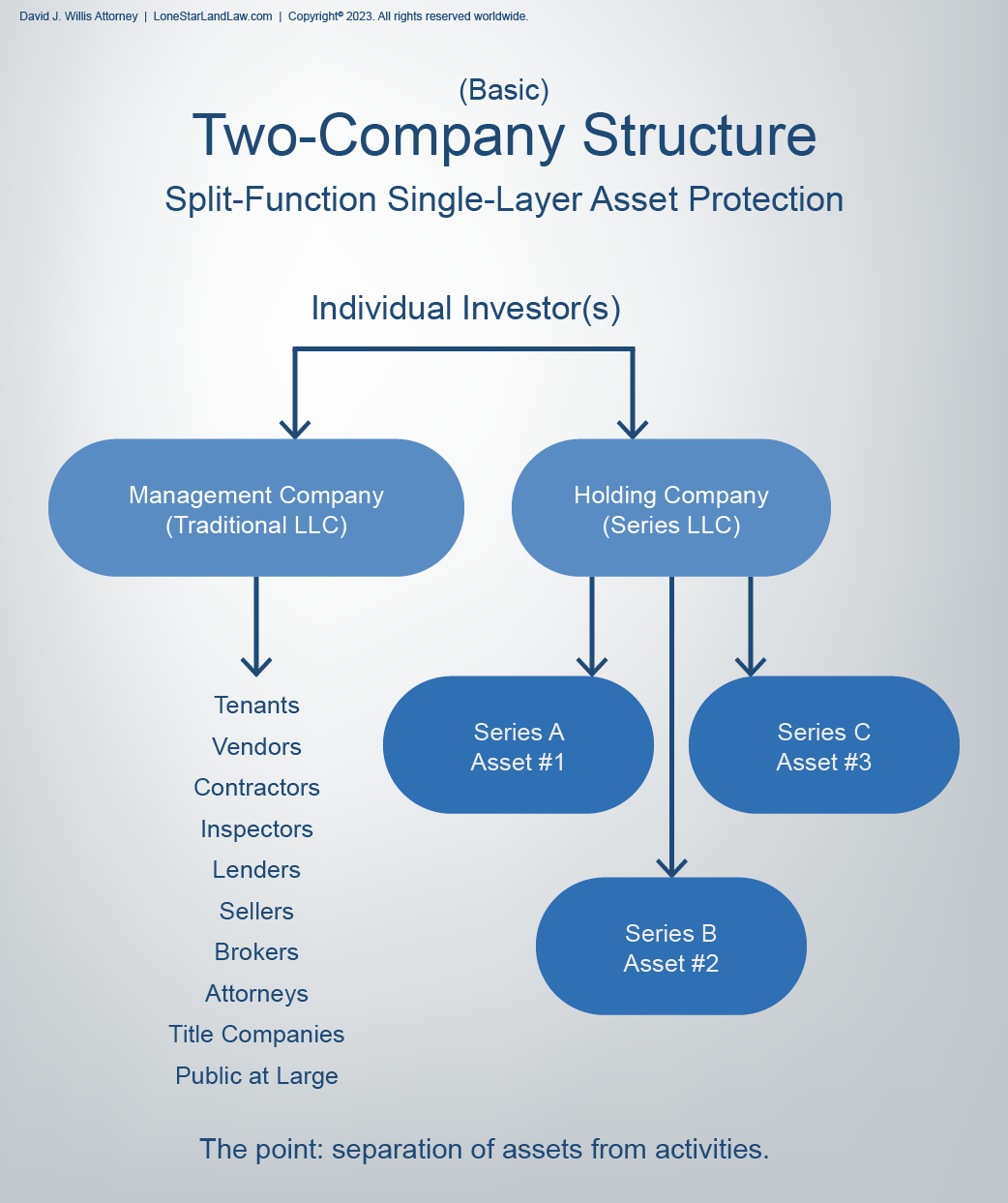

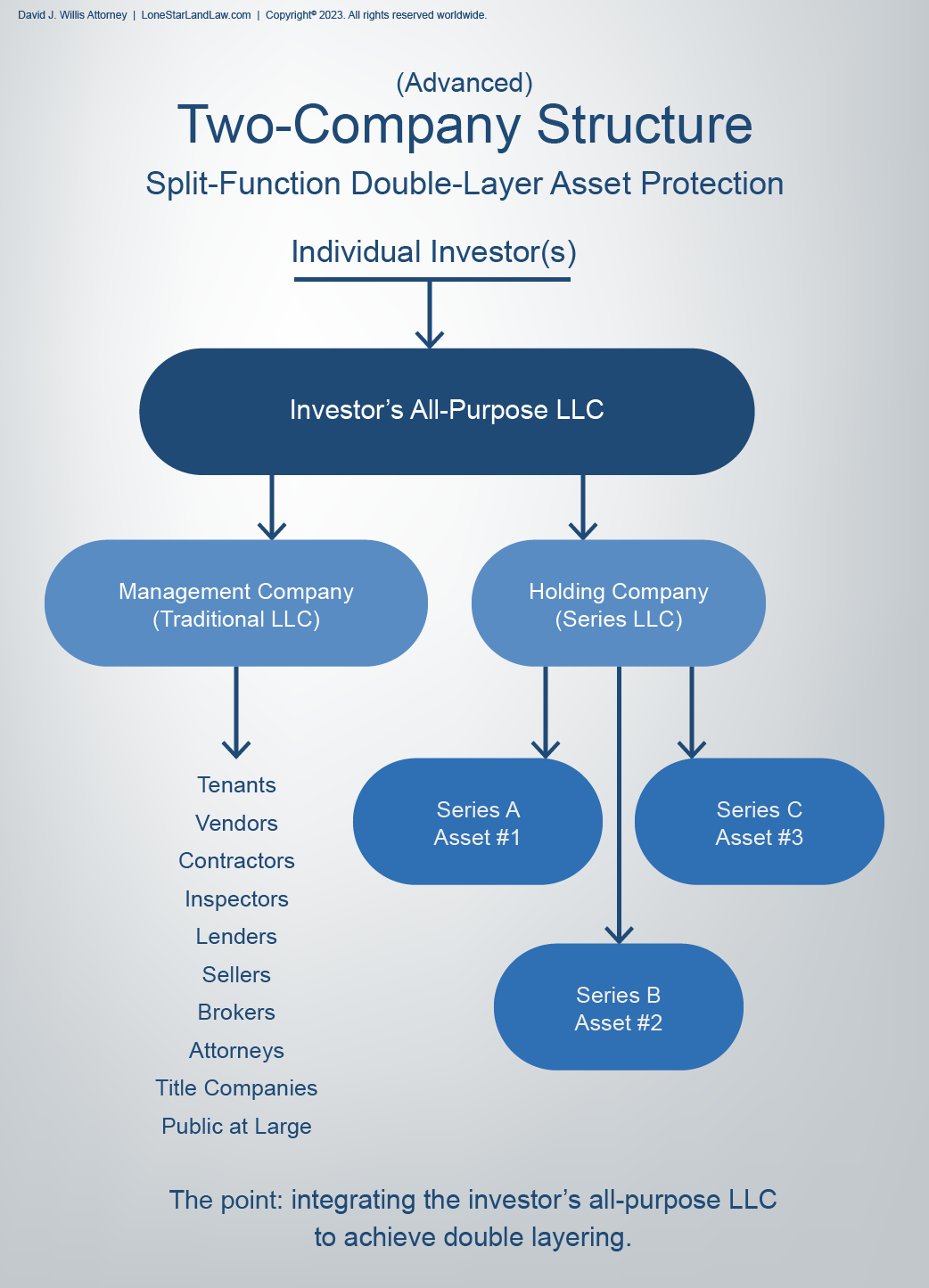

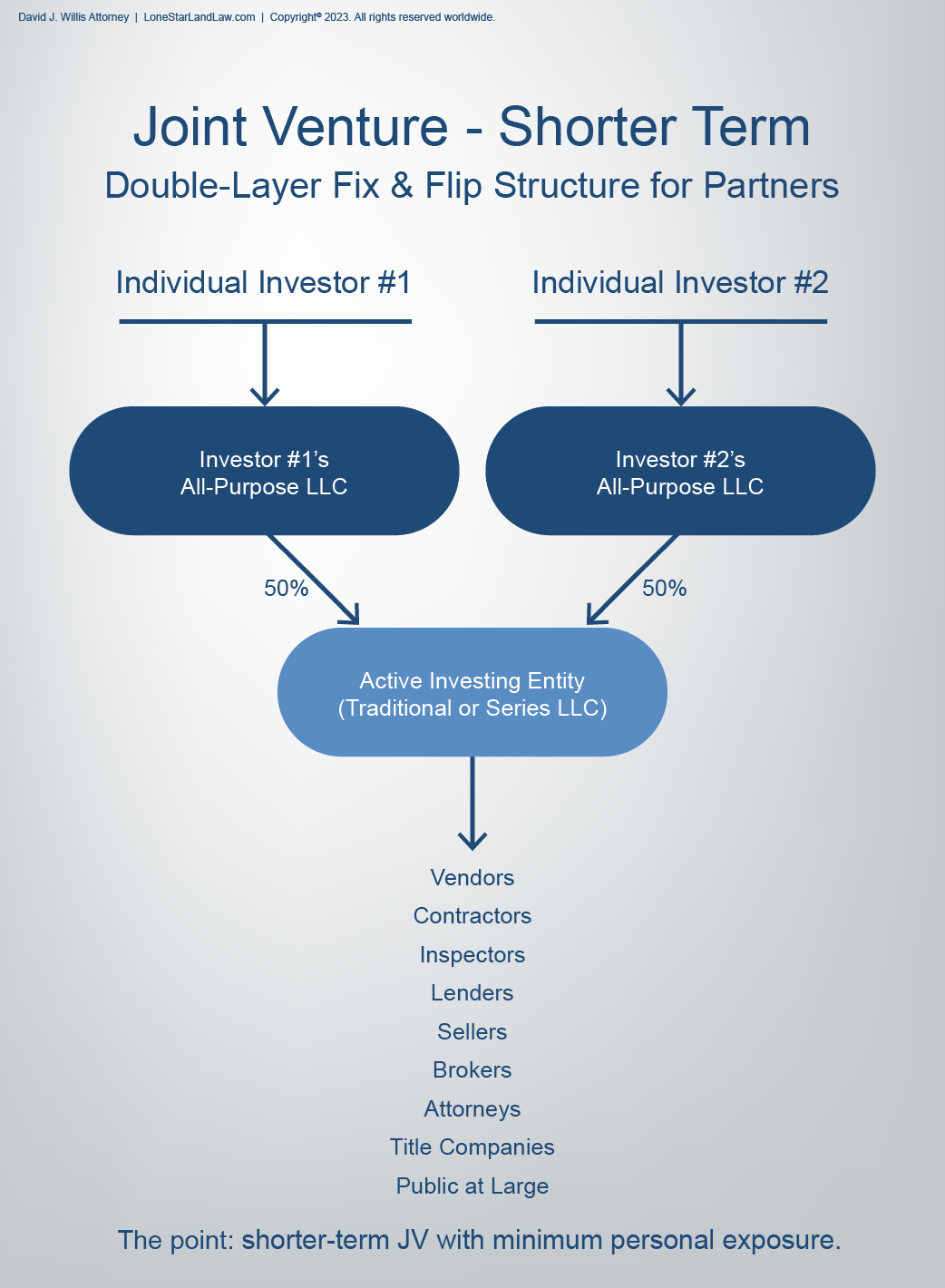

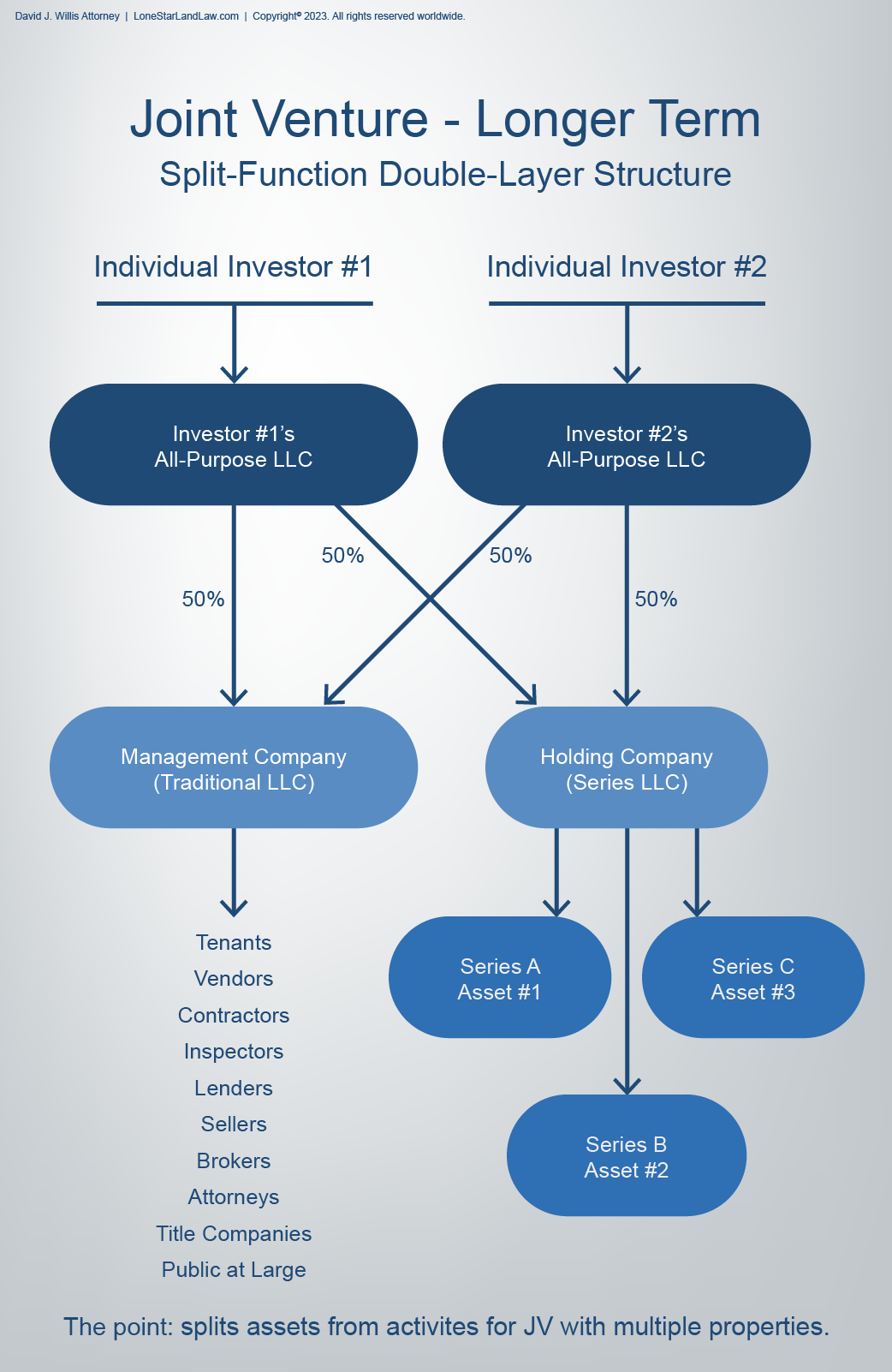

Asset protection structures are often better visualized than explained. Each of the following graphics is an example with many possible variations. Our goal is to custom-design entity structures that maximize asset protection while providing for efficient operation. Simpler is usually better in our view, so we strive for structures that are clean and free of unnecessary duplication.

Because this firm has significant litigation experience, we also focus on creating structures that will withstand a court challenge.

Asset Protection Structures

1. Two-Company Structure (Basic)

2. Two-Company Structure (Advanced)

3. Joint Venture—Shorter Term

4. Joint Venture—Longer Term

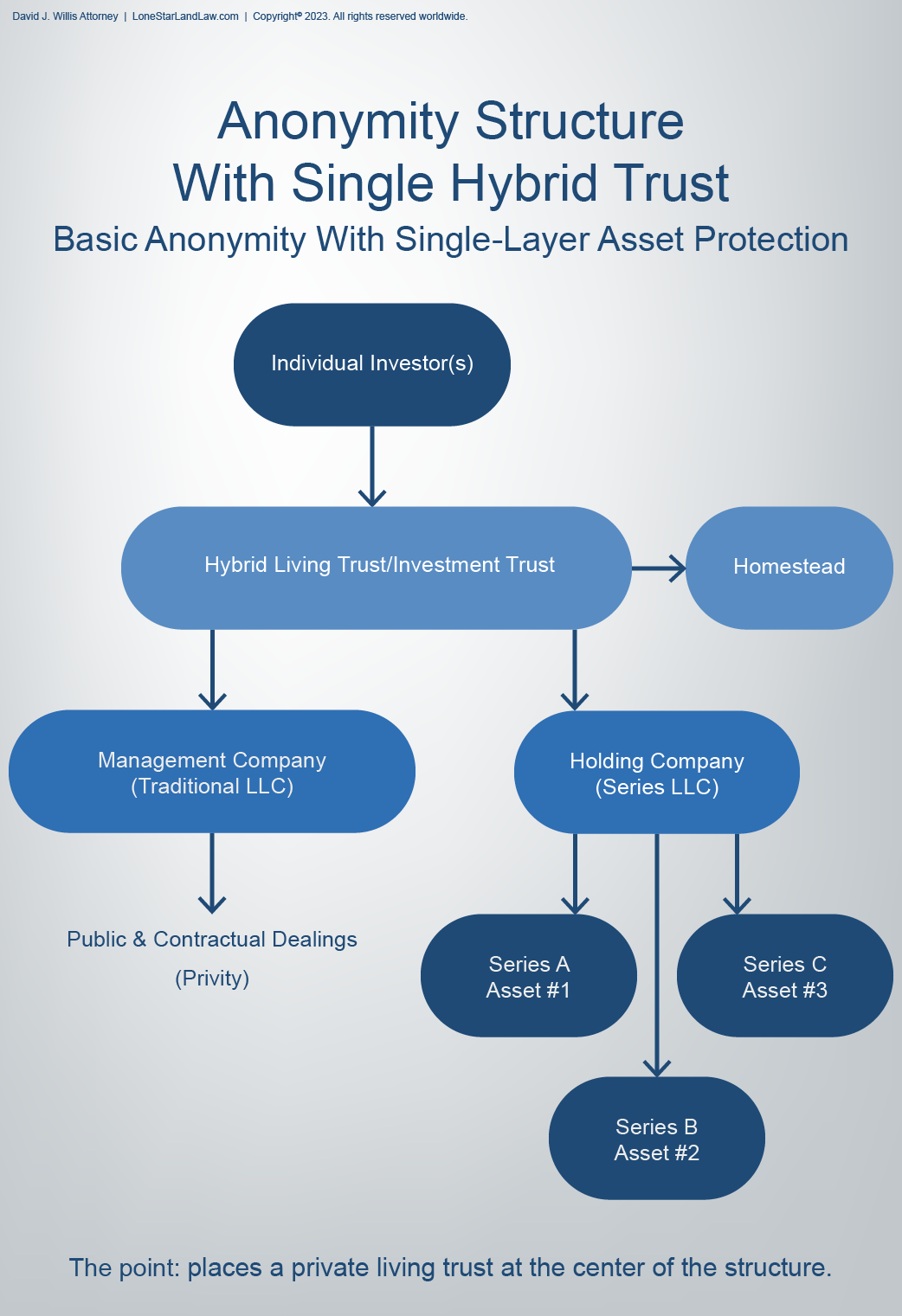

5. Anonymity Structure with Single Hybrid Trust

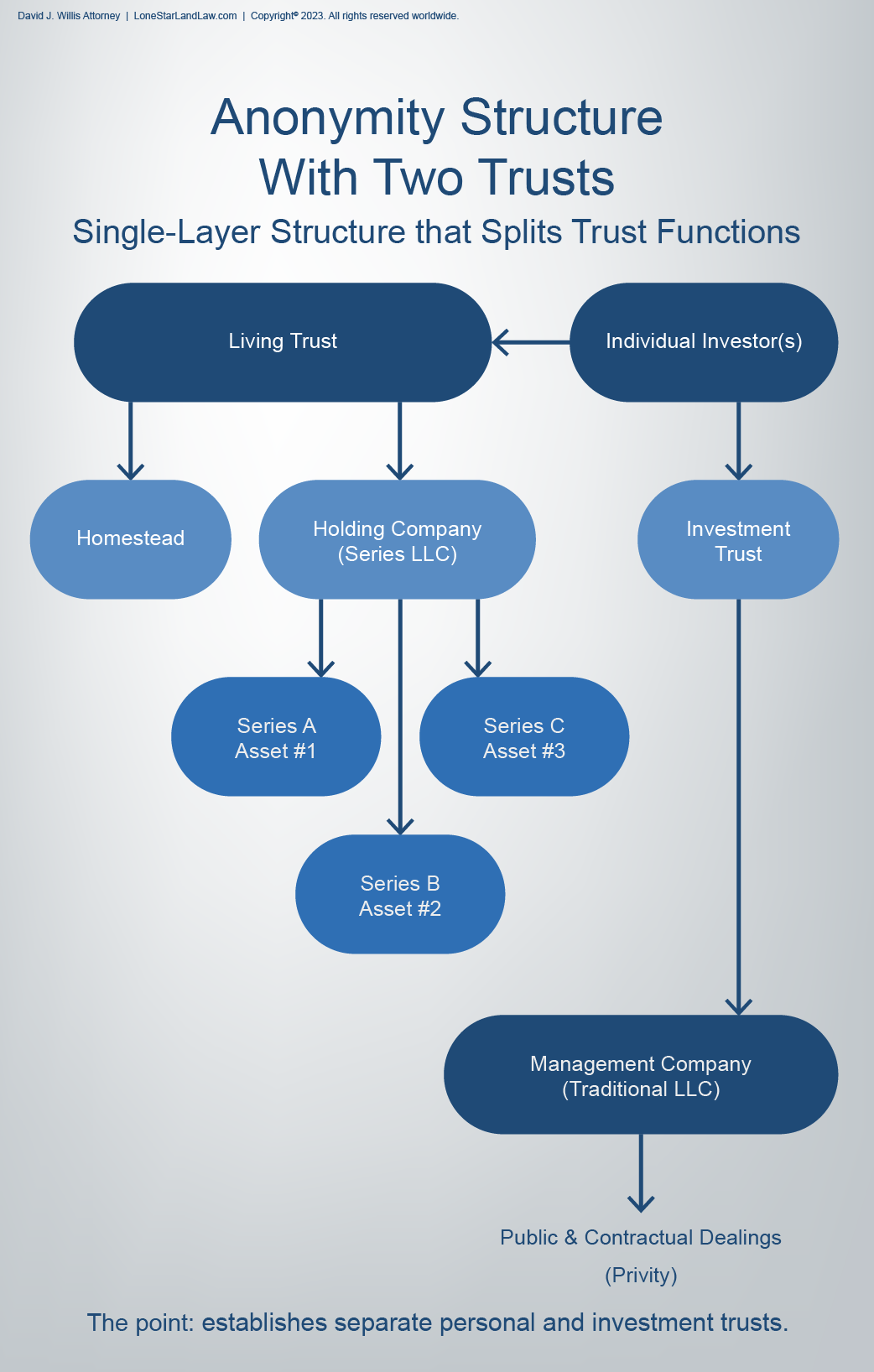

6. Anonymity Structure with Two Trusts

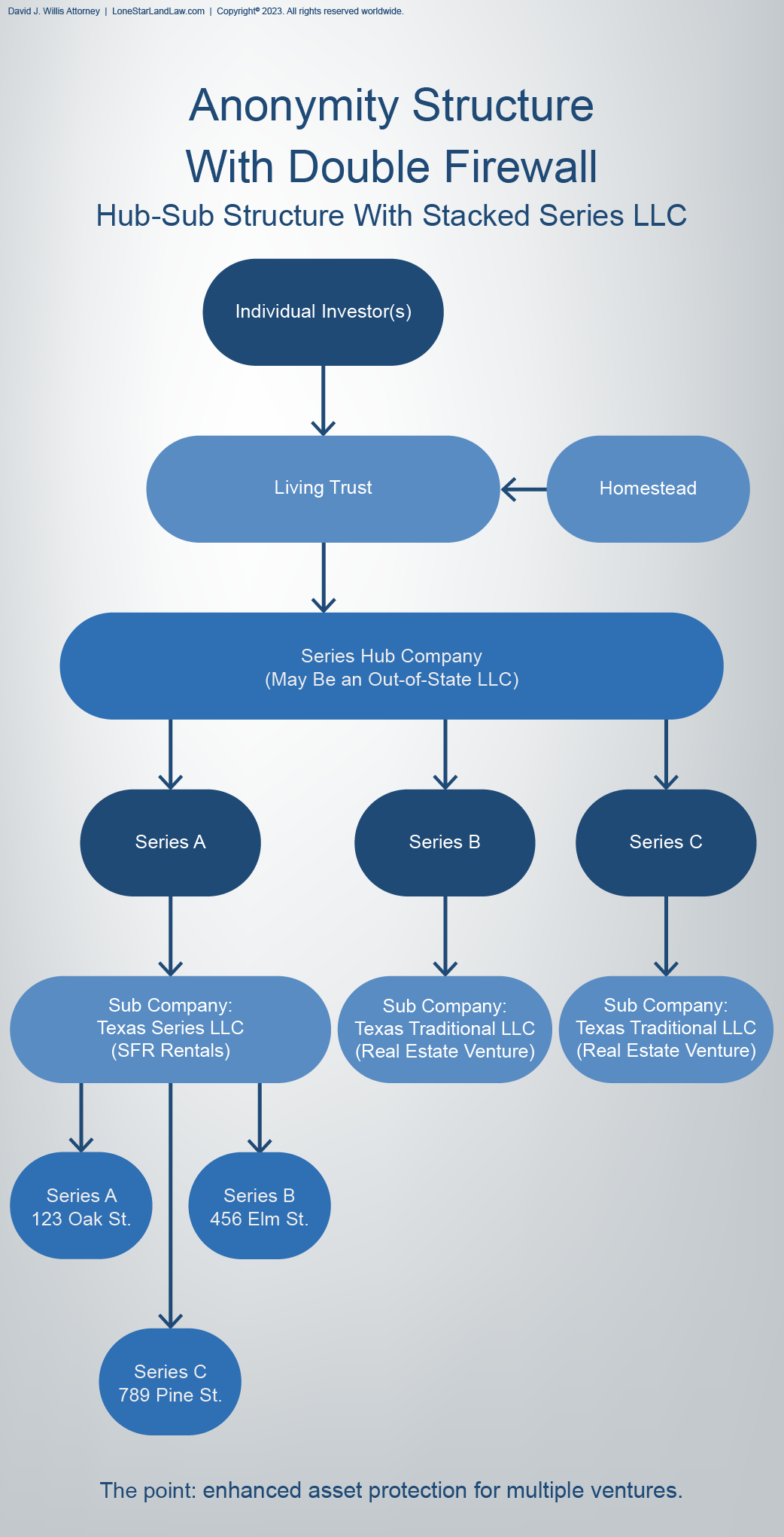

7. Anonymity Structure with Double Firewall (Hub-Sub)

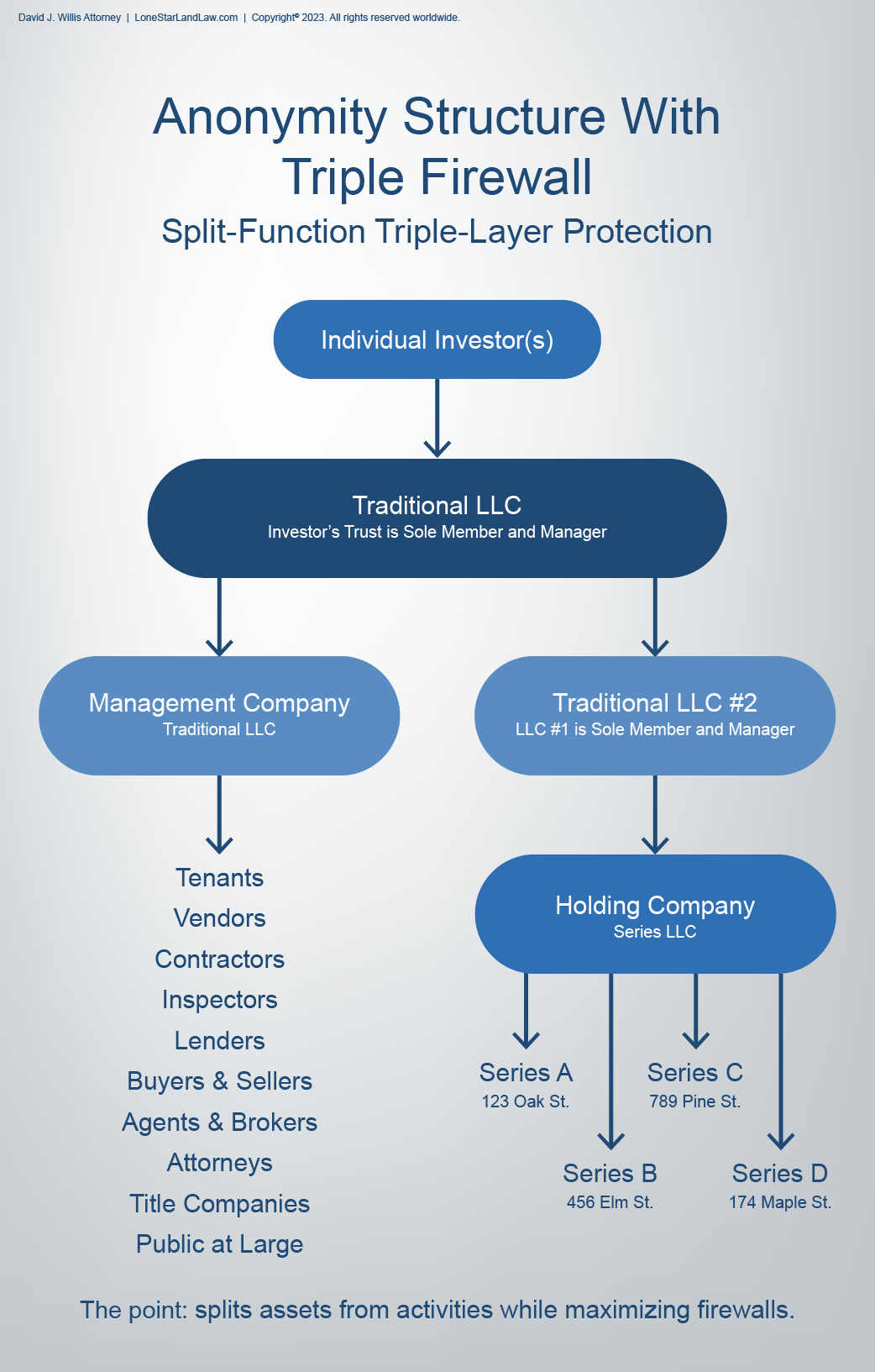

8. Anonymity Structure with Triple Firewall

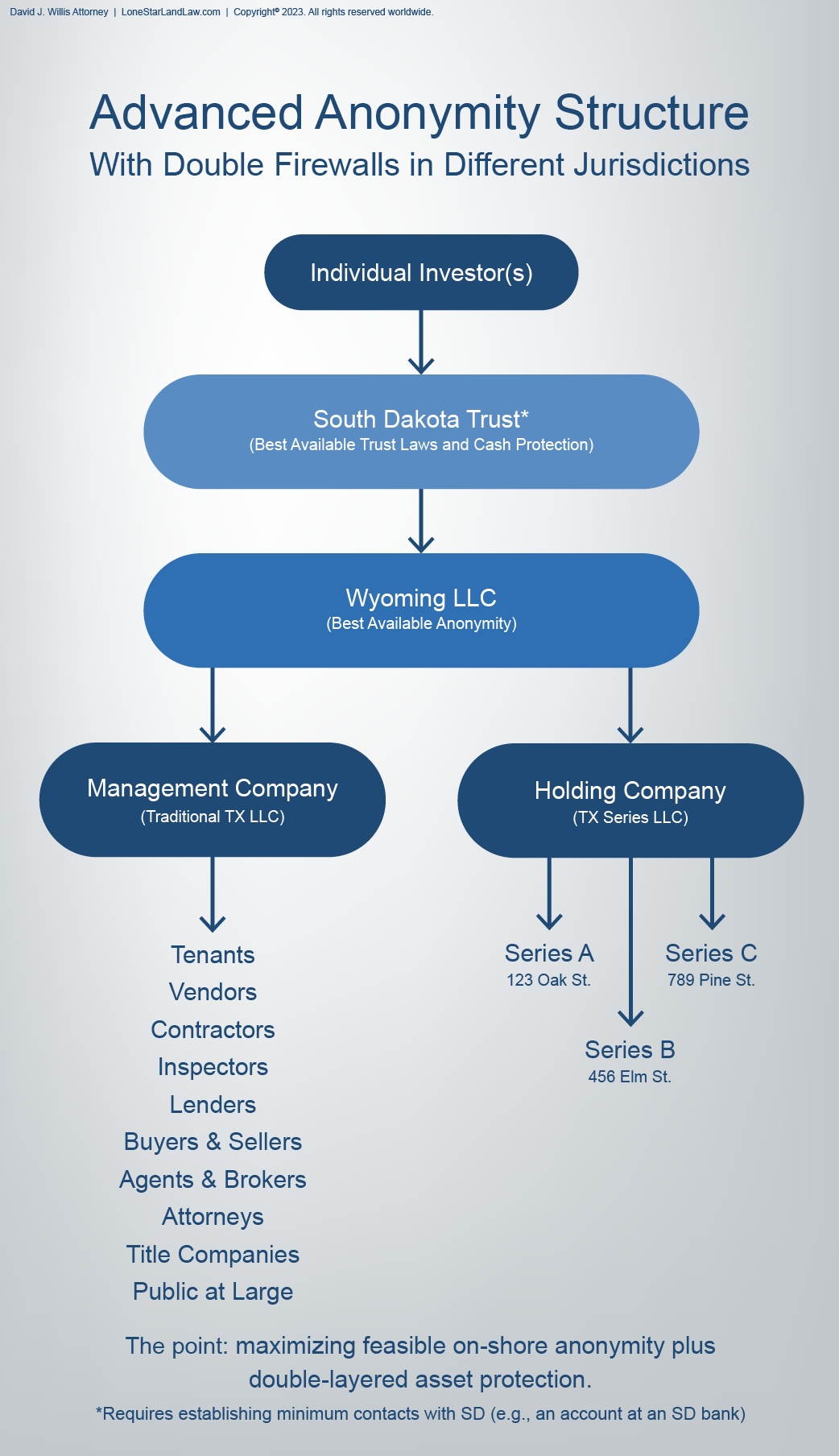

9. Advanced Anonymity Structure

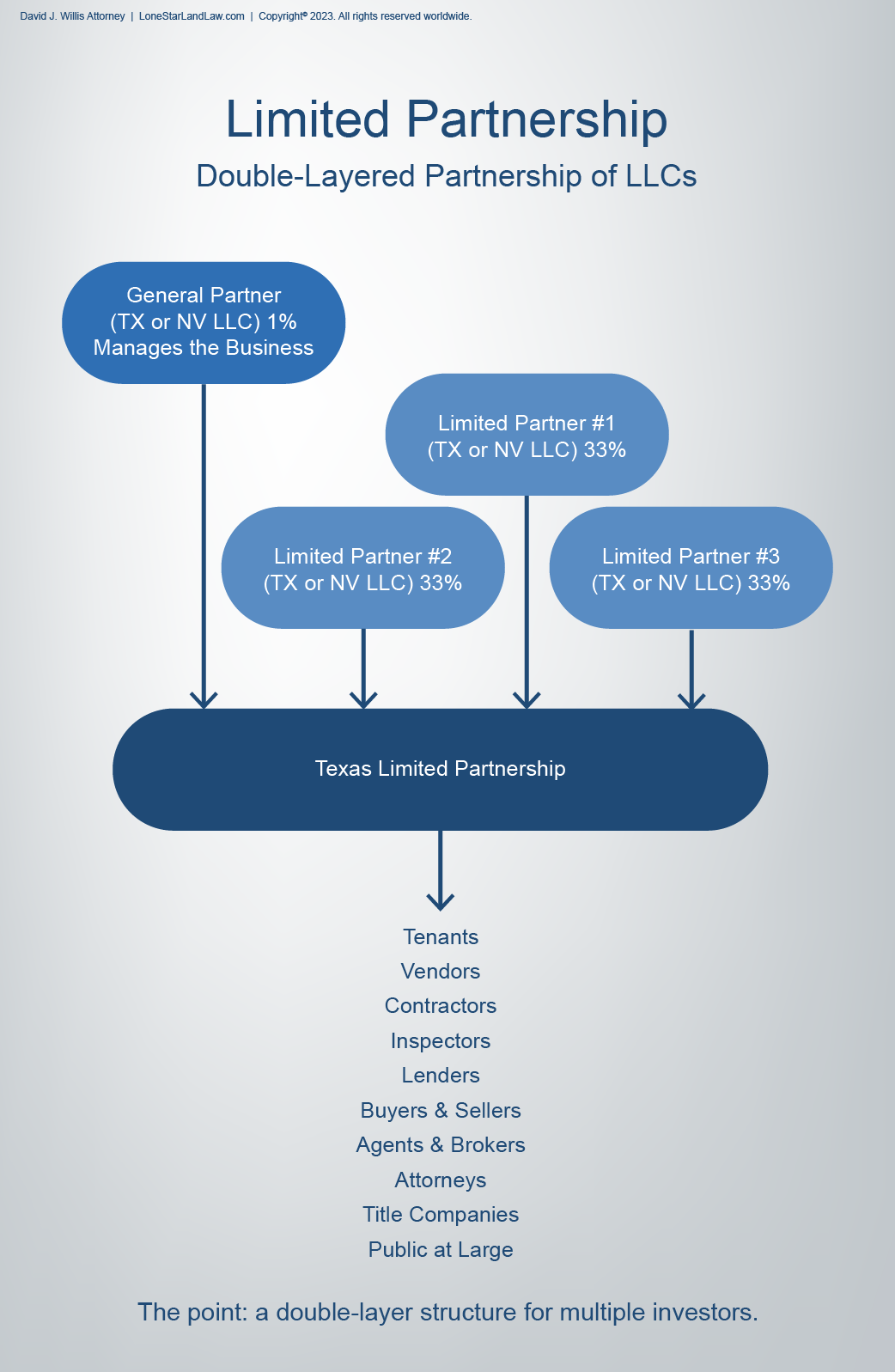

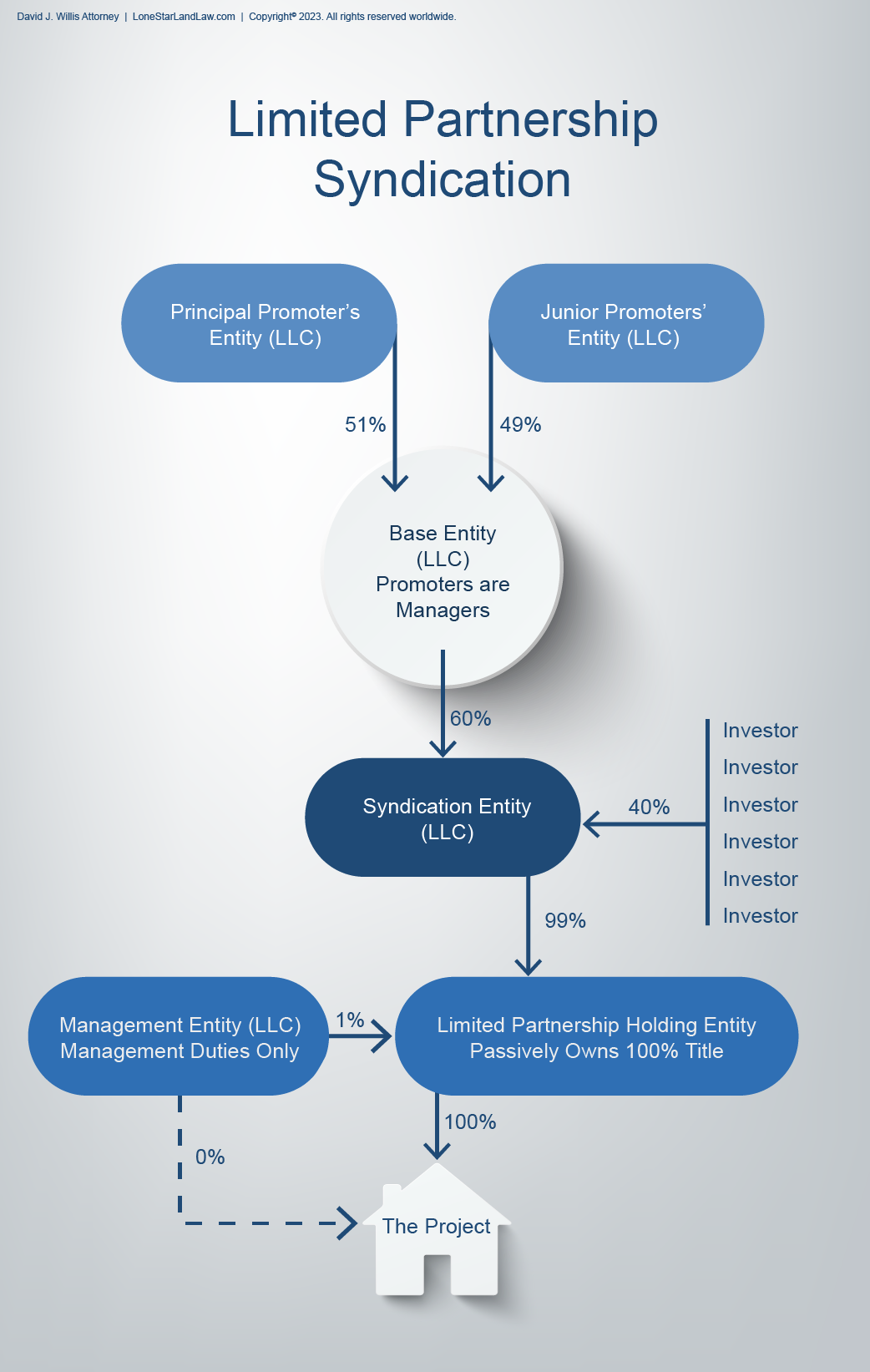

10. Limited Partnership Structure

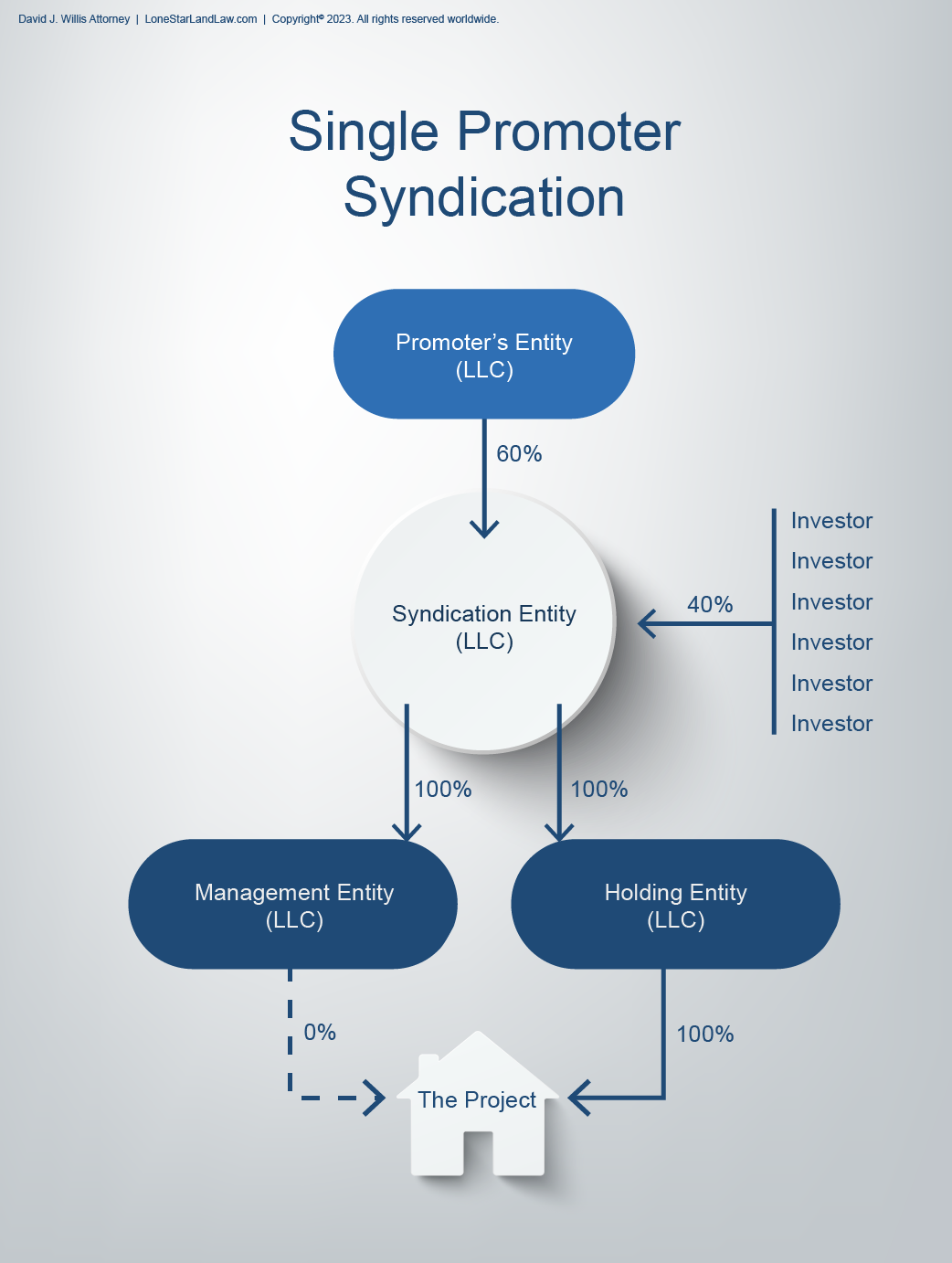

11. Single Promoter Syndication

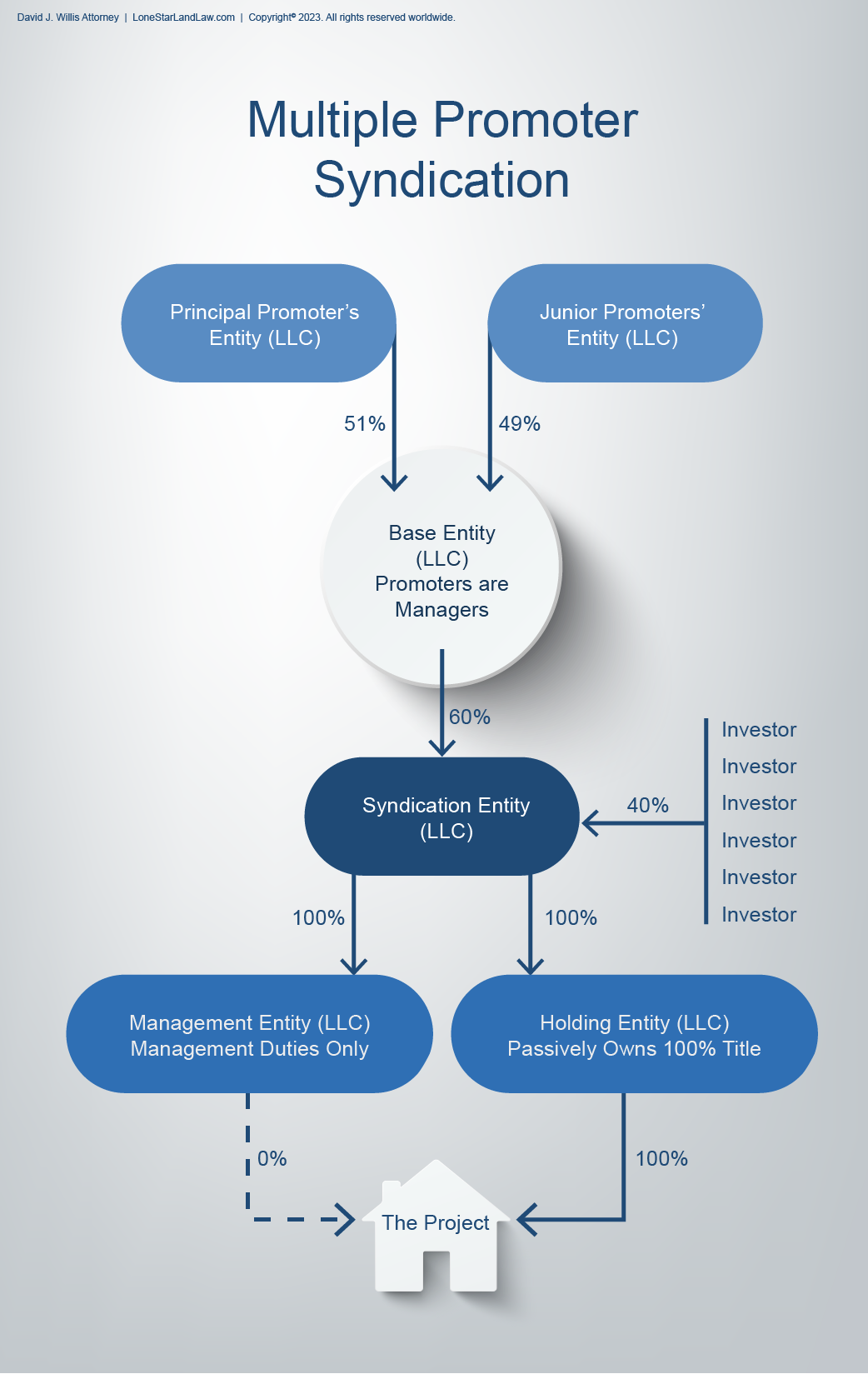

12. Multiple Promoter Syndication

13. Limited Partnership Syndication

DISCLAIMER

The information provided above is for general educational purposes only and is not offered as legal advice upon which anyone may rely. The law changes. Legal counsel relating to your individual needs and circumstances is advisable before taking any action that has legal consequences. Consult your tax advisor as well since we do not give tax advice. This firm does not represent you unless and until it is retained and expressly retained in writing to do so.

Copyright © 2023 by David J. Willis. All rights reserved worldwide. David J. Willis is board certified in both residential and commercial real estate law by the Texas Board of Legal Specialization. More information is available at his website, www.LoneStarLandLaw.com.

Review from a Physician Real Estate Investor

“During some late night internet research I stumbled upon some good legal info from David J Willis. I read several pages of well written real estate law, and decided to buy his book “Real Estate Law & Asset Protection for Texas Real Estate Investors.” Since then I’ve formed a new LLC with David, I was very impressed with the speed at which he answers questions and gets things done! Thanks David”

Review from an Attorney Real Estate Investor

“David J. Willis is an expert in the field of asset protection. He provided excellent legal advice to me on several issues. The online process that David’s law firm utilizes is very easy to use and David responded to my questions very quickly. I am a lawyer but have no expertise whatsoever in this area of law. I will continue to be a client of David’s in the future and I highly recommend him.”