Texas Real Estate Law

Asset Protection in Texas

LLCs and Series LLCs for Investors

David J. Willis Attorney & Broker

LoneStarLandLaw.com

Houston, Texas

Attorney and broker David J. Willis of Houston assists buyers, sellers, and investors in real estate transactions, document preparation, trusts, and LLC formation.

Clients include real estate professionals, physicians, attorneys, and others who seek to acquire, manage, and protect a portfolio of rental properties.

Mr. Willis is author of the popular book Real Estate Law & Asset Protection for Texas Real Estate Investors.

Scroll down to see Mr. Willis’ 80+ articles on Texas real estate law, Texas business law, and asset protection in Texas.

Read our many five-star reviews.

After decades of traditional office practice, the firm now offers many legal services online with no office visit required. All new clients and new cases are accepted exclusively through this website, not by phone.

Our online consultation process has proven efficient and popular with clients. The introductory online consult fee for most new clients is a flat fee of $250 (limitations apply).

Contact us. Your inquiry is confidential.

We produce custom legal documents designed to maximize our clients’ best interests. Contracts, warranty deeds, notes, deeds of trust, assignments, and many more are available online.

Review/comment on unsigned residential real estate contracts (TREC and TXR) begins at $250 (limitations apply).

We offer special expertise in creative transactions such as wraparounds, “subject to” contracts, seller financing, wholesaling, and investor trusts.

Documents are designed to comply with Dodd-Frank, the Safe Act, FinCEN beneficial ownership rules, and other relevant regulatory regimes.

We do not do in-office closings, escrow client funds, or offer title insurance.

Our asset protection strategies simplify operations and improve defense against lawsuits.

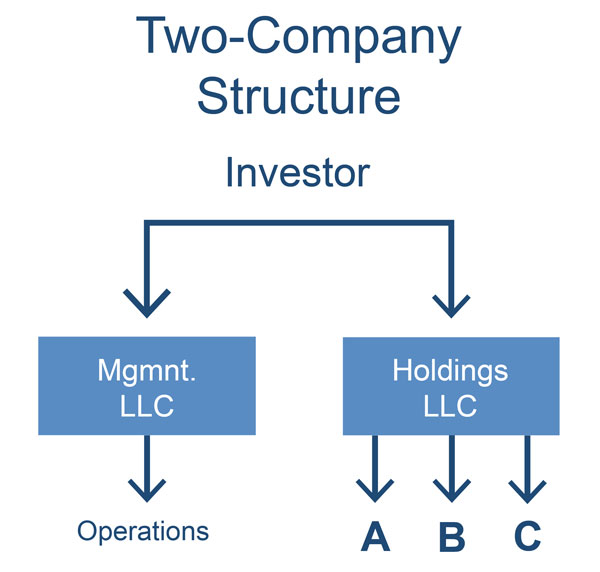

We form both traditional LLCs and series LLCs in Texas and Nevada as part of our recommended two-company structure for real estate investors.

Browse graphics of other asset protection structures.

Living Trusts in Texas real estate are useful for probate avoidance, ease of transfer, and investment advantages. They can also be creatively integrated into an LLC asset protection structure.

Read our articles on investor land trusts and living trusts for the Texas homestead.

Mr. Willis is board certified in residential real estate law and commercial real estate law by the Texas Board of Legal Specialization.

He is also a Texas real estate broker and author of Real Estate Law & Asset Protection for Texas Real Estate Investors.

“The most important real estate book you will ever read!”

Attorney Keaton Frieberg, San Antonio

★★★★★

“David offers a wealth of sage advice with keen insights.”

Attorney Brian Gutierrez, Bryan

★★★★★

2026 Edition – 817 Pages

“As an attorney I am familiar with David Willis’ expertise in real estate. If David wrote it, you can depend on it! I highly recommend David’s book.”

Attorney Paul Spielvogel, The Woodlands

★★★★★

This book is amazing! Many great tips and creative solutions.”

Attorney Zachary Copp, Dallas

★★★★★

“David was incredibly knowledgeable in structuring a Texas Series LLC for my real estate investments. I appreciate his responsiveness, attention to detail, and practical advice. Highly recommend!”

Faraz Ali

★★★★★

“David Willis’ knowledge of real estate law and transactions is superb. I have never encountered a more efficient or thorough process than that offered by David. He is simply impressive!”

L. Hunt

★★★★★

“David’s LLC process is incredibly well organized. Fees are very reasonable, especially considering the quality of service received. Highly recommend!”

Lyle Johnson

★★★★★

“Six years ago, David guided me through implementing an asset protection plan. I was sued by two major banks. Both got six-figure judgments but no one collected a dime!”

Sam Gordon

★★★★★

“David Willis is by far the easiest attorney I’ve ever dealt with. I give him my highest possible recommendation without reservation.”

Sandeep Nanda

★★★★★

“Nice dealing with an expert! Mr. Willis answered all my questions the same day. Being able to do everything online saved us numerous trips to his office. His book is very helpful also.”

Doug Warner

★★★★★

“Words cannot express how grateful my family and I are for Mr. Willis’ work. He did a lot more for us online than the other attorneys we met in person.”

Yami Vazquez

★★★★★

We are primarily a flat-fee office although hourly billing ($350) and retainer arrangements are available. No contingency fees. Legal fees are transparently posted along with policies that apply to all clients and inquirers.

Your inquiry is confidential. Adherence to high standards of ethics is part of our firm philosophy. We subscribe to The Texas Lawyer’s Creed and the Code of Ethics of the National Association of Realtors.

The principal location of the law office of David J. Willis Attorney is Houston, Texas although our practice is statewide. We serve Harris County, Fort Bend County, and Montgomery County as well as Houston, The Woodlands, Sugar Land, Conroe, Galveston, Dallas, Fort Worth, Austin, San Antonio, Midland, Brownsville, El Paso, and all areas of Texas. Mr. Willis counsels clients in Texas real estate law, Texas business law, and is a Texas LLC attorney for anyone forming an entity such as a real estate partnership or joint venture, a Texas series LLC, or a Nevada series LLC.